That Depends on What Your Definition of Rich is

If we aren’t careful, we can get caught up in chasing the “almighty dollar”. There’s nothing wrong with money as long as it doesn’t become the only thing you’re focused on.

We can also go too far the other way and see money as evil. It’s not. Money is a tool that make ministry possible. It’s much easier to rebuild a home damaged by a storm if there’s money to buy the building materials.

One definition of rich is specific to money, but another is plentiful or abundant. What is it that you want to have in plenty and abundance?

Love and joy are the kind of things that makes us rich.

Here’s an excerpt from a story about being rich from Eddie Ogan:

I’ll never forget Easter 1946. My dad had died five years before, leaving Mom with seven school kids to raise and no money.

A month before Easter the pastor of our church announced that a special Easter offering would be taken to help a poor family.

When we got home, we talked about what we could do. We decided to buy 50 pounds of potatoes and live on them for a month. This would allow us to save $20 of our grocery money for the offering.

We thought that if we kept our electric lights turned out as much as possible and didn’t listen to the radio, we’d save money on the electric bill.

My sister and I got as many house and yard cleaning jobs as possible, and both of us babysat for everyone we could.

For 15 cents we could buy enough cotton loops to make three pot holders to sell for $1. We made $20 on pot holders.

That month was one of the best of our lives.

Every day we counted the money to see how much we had saved. At night we’d sit in the dark and talk about how the poor family was going to enjoy having the money the church would give them.

We had about 80 people in church, so figured that whatever amount of money we had to give, the offering would surely be 20 times that.

The night before Easter we were so excited, we could hardly sleep. We didn’t care that we wouldn’t have new clothes for Easter; we had $70 for the sacrificial offering.

We could hardly wait to get to church! On Sunday morning, rain was pouring. We didn’t own an umbrella, and the church was over a mile from our home, but it didn’t seem to matter how wet we got. Darlene had cardboard in her shoes to fill the holes. The cardboard came apart, and her feet got wet.

When the sacrificial offering was taken, we were sitting on the second row from the front. Mom put in a $10 bill, and each of us kids put in a $20.

As we walked home after church, we sang all the way.

Late that afternoon the minister drove up in his car. Mom went to the door, talked with him for a moment, and then came back with an envelope in her hand.

We asked what it was, but she didn’t say a word. She opened the envelope and out fell a bunch of money. There were three crisp $20 bills, one $10 and seventeen $1 bills.

Mom put the money back in the envelope. We didn’t talk, just sat and stared at the floor. We had gone from feeling like millionaires to feeling like poor white trash.

We kids had such a happy life that we felt sorry for anyone who didn’t have our Mom and Dad for parents and a house full of brothers and sisters and other kids visiting constantly.

I knew we didn’t have a lot of things that other people had, but I’d never thought we were poor.

That Easter day I found out we were. The minister had brought us the money for the poor family, so we must be poor. I didn’t like being poor. I looked at my dress and worn-out shoes and felt so ashamed–I didn’t even want to go back to church. Everyone there probably already knew we were poor!

We sat in silence for a long time. Then it got dark, and we went to bed. All that week, we girls went to school and came home, and no one talked much.

Finally on Saturday, Mom asked us what we wanted to do with the money. What did poor people do with money? We didn’t know. We’d never known we were poor.

We didn’t want to go to church on Sunday, but Mom said we had to. Although it was a sunny day, we didn’t talk on the way.

At church we had a missionary speaker. He talked about how churches in Africa made buildings out of sun dried bricks, but they needed money to buy roofs. He said $100 would put a roof on a church. The minister said, “Can’t we all sacrifice to help these poor people?”

We looked at each other and smiled for the first time in a week.

Mom reached into her purse and pulled out the envelope and we put it in the offering.

When the offering was counted, the minister announced that it was a little over $100. The missionary was excited. He hadn’t expected such a large offering from our small church. He said, “You must have some rich people in this church.”

Suddenly it struck us! We had given $87 of that “little over $100.”

We were the rich family in the church! Hadn’t the missionary said so? From that day on I’ve never been poor again.

I’ve always remembered how rich I am because I have Jesus!

You can read Eddie’s full story here.

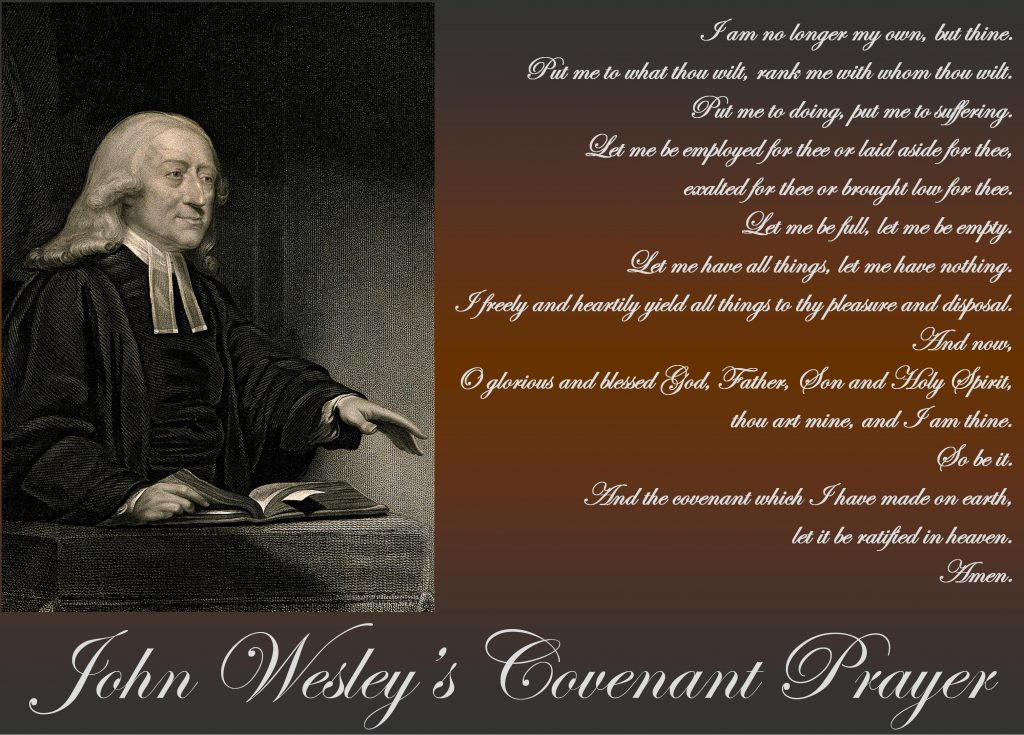

When money is our focus, it doesn’t matter how much we have. If we don’t have our priorities in the right place…we’re poor. Money is an important tool to be able to build God’s Kingdom…but it shouldn’t be our focus.

Fulfilling our purpose with Jesus is what makes us truly rich.

What if there’s an underground water line leaking in your back yard. You can see that spot where the grass is green in an otherwise brown lawn. The water bill is more than ever before and getting bigger each month. That doesn’t matter, the prospect of getting your shovel out of the tool shed and digging is more than you can bear to think about. So, you put it off and pretend that it’s not a problem.

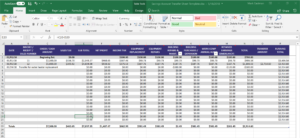

What if there’s an underground water line leaking in your back yard. You can see that spot where the grass is green in an otherwise brown lawn. The water bill is more than ever before and getting bigger each month. That doesn’t matter, the prospect of getting your shovel out of the tool shed and digging is more than you can bear to think about. So, you put it off and pretend that it’s not a problem. The same thing is true about the Savings Transfer Sheet. If you will take the time to get it out of the tool box, spend some time learning how to use it and use it regularly, it will make a significant difference in stopping your financial leaks.

The same thing is true about the Savings Transfer Sheet. If you will take the time to get it out of the tool box, spend some time learning how to use it and use it regularly, it will make a significant difference in stopping your financial leaks.