The Thing to Remember About Tools Is…They’re Only Good if You Use Them

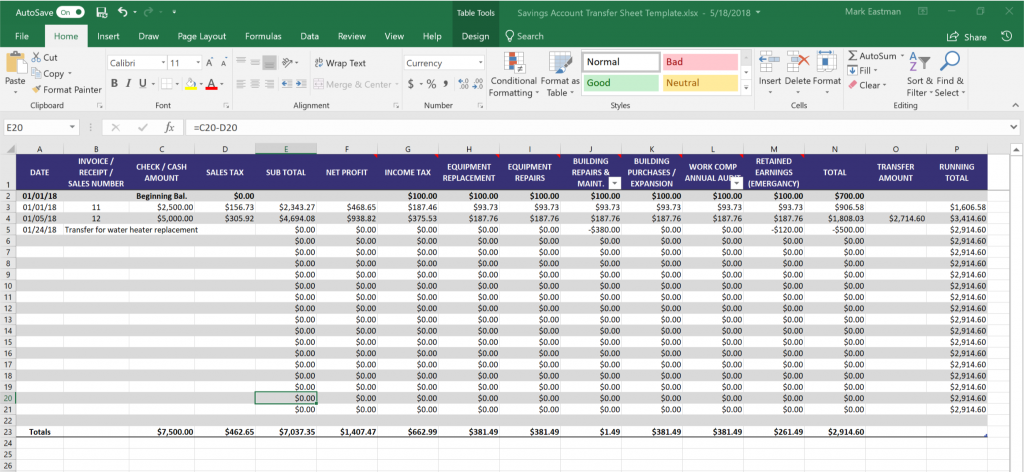

Over the last couple of weeks, we have discussed why it’s critical to save money for those big irregular expenses and unexpected emergencies. Next, we began the process needed to start building a “Rainy Day” fund by determining how much and for what. The Savings Transfer Sheet is like any other tool, it doesn’t do you any good if you don’t use it.

As is the case with everything that’s worth doing, starting is the hard part. Saving money is no different. It’s like digging a hole.

What if there’s an underground water line leaking in your backyard. You can see that spot where the grass is green in an otherwise brown lawn. The water bill is more than ever before and getting bigger each month. That doesn’t matter, the prospect of getting your shovel out of the tool shed and digging is more than you can bear to think about. So, you put it off and pretend that it’s not a problem.

The green spot in the yard keeps getting bigger and greener. The water bill keeps getting bigger too. You decide to cover the spot in the back yard with an above ground swimming pool. That took care of it…no more green spot. You know what they say. Out of sight out of mind.

Then one day you get a water bill that is so big you decide that you’ve got to do something. So, you drain the pool, get a shovel, and start digging. Then before you know it, you’ve uncovered the pipe, found the leak, made the repair, and filled the hole.

That wasn’t near as bad as you thought it was going to be. Once again, you are aware that this is one of those times when the overwhelming dread was way worse than the actual process. The next water bill is back where it used to be, and you wonder why you weren’t more proactive.

A shovel is a simple tool that’s easy to use. It can fix a problem before it gets too big, but only if you use it. If you don’t, the outcome can be devastating.

The same thing is true about the Savings Transfer Sheet. If you’ll take the time to get it out of the toolbox, spend some time learning how to use it, and use it regularly, it will make a significant difference to stop your financial leaks.

Wouldn’t you like to have your money filling up the pool rather than leak out of it.

If you would like to learn more about the Savings Account Transfer sheet, schedule a free 30-minute construction company consultation.

passed since then, that for most people it’s become a distant memory. If you have ever talked with someone who went through the depression or a similar experience, saving money was more than something that needed to be done, it often was the difference between life and death.

passed since then, that for most people it’s become a distant memory. If you have ever talked with someone who went through the depression or a similar experience, saving money was more than something that needed to be done, it often was the difference between life and death. way to separate money that would be needed later. How was I going to do it? Several years ago, my wife and I found out about Dave Ramsey and his Financial Peace Program**. It is a program that teaches you to, “Live like no one else, so that later you can live like no one else.” The very first lesson he teaches is “Super Saving”. It is a common-sense approach to saving money and the reasons it is important to do so. This was great for my personal finances but wasn’t an exact fit for my business.

way to separate money that would be needed later. How was I going to do it? Several years ago, my wife and I found out about Dave Ramsey and his Financial Peace Program**. It is a program that teaches you to, “Live like no one else, so that later you can live like no one else.” The very first lesson he teaches is “Super Saving”. It is a common-sense approach to saving money and the reasons it is important to do so. This was great for my personal finances but wasn’t an exact fit for my business.