It’s Amazing How Things Become Clear with a Limited Amount of Time

The discussion in our mastermind group this past week was around productivity and how to be more productive. It started with the question of, what does productivity mean and what does it look like to be productive?

What is productivity? Now there’s a question for you to answer. We have a limited amount of time in a day, a year, or a life.

Productivity generally refers to the ability of an individual, team, or organization to work efficiently within that time in order to maximize output.

High productivity results from a mix of factors: motivation, personality, natural talent, training or education, environment, support from others, time management, and things that happen that are outside of our control.

Output / Input = Productivity

So, what is output? This is one of the things that makes the question of productivity so hard to answer. But this is where we need to start with the productivity question. What is the most important thing to accomplish in this finite amount of time we’ve been given?

There are so many things trying to get on the “to do” list and each one competing for the top position. Deciding which one should get that spot is tough. There are so many great and important things that we need or want to do.

It’s easy to say that we have limited time, but hard to actually schedule things that way.

My computer’s battery is not lasting as long as it did when it was new. Recently while working out of the office, without the power cord, I had 2-3 things that I wanted to get done before the computer shut down. This limited time forced me to sort and prioritize them.

How do we decide what to say yes to?

Emergency situations often require triage. This is the process of prioritizing a patient’s treatments based on the severity of their condition and the resources available. In these situations, victims are divided into three categories.

- Those who are likely to live, regardless of what care they receive;

- Those who are unlikely to live, regardless of what care they receive;

- Those for whom immediate care might make a positive difference in outcome.

These choices aren’t easy and often require a quick “gut decision”. A pre-determined system, training, and experience aid in the process and provide for the greatest number of survivors.

Another life and death choice is deciding who gets a transplant when there are a limited number of organ donations available. Take for example a set of twins who both need a liver transplant, and their father has one liver to give. Which little girl gets it? The early thoughts of a father would be to give half to each. The problem with this, half wouldn’t help either. The final decision will be determined by which one needs it most or which one is most likely to survive.

Most of the choices that we make in business aren’t this critical…or are they? The decisions we make can mean life or death for our business.

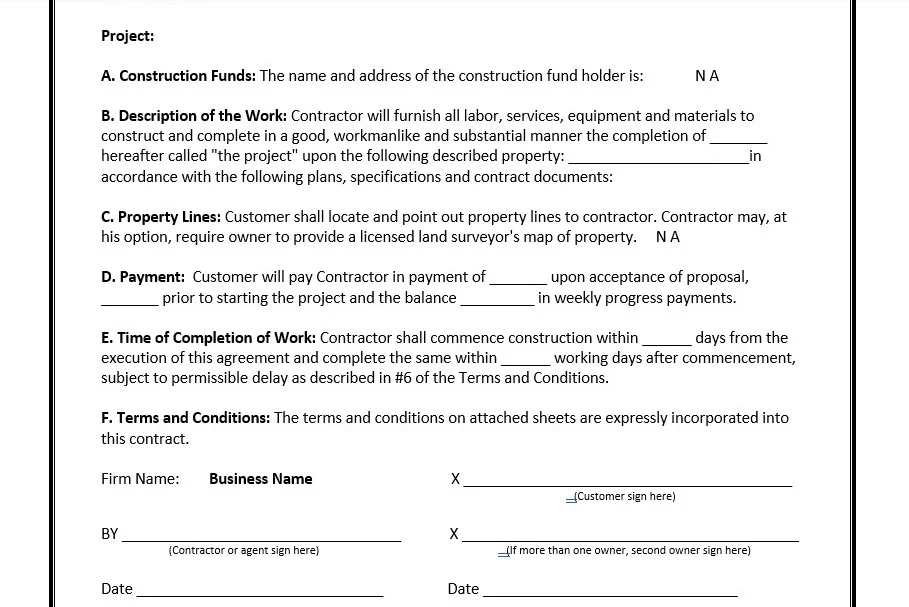

In medical life or death situations, there is a system and plan in place before hand. This same type of system should be implemented in our business. We should predetermine how we are going to choose the most important thing to the life of our business. This is where things get hard.

What makes one thing more important than another?

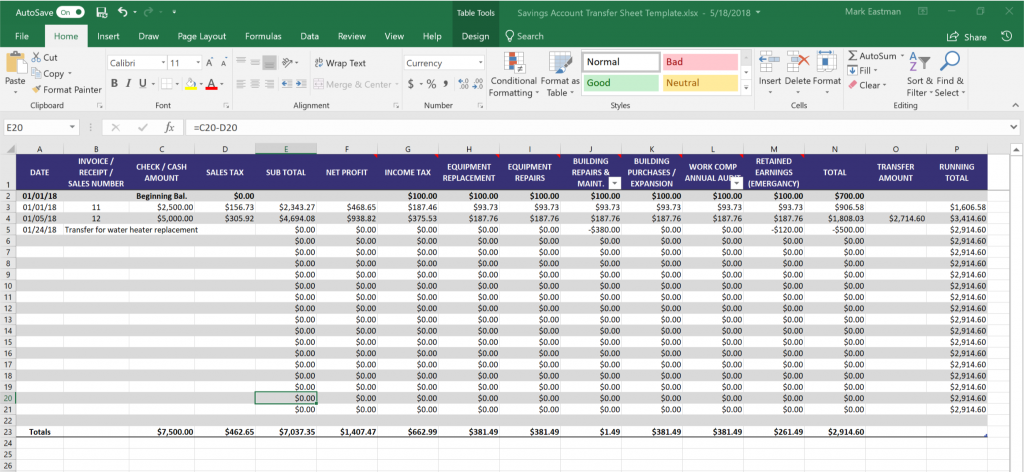

What should be the highest priority? Should it be production or proposals, record keeping or customer service, marketing or staff? We’re faced with tough decisions in business every day.

I can’t answer this question for you, but having a “business triage” system will give your business the highest chance for survival.

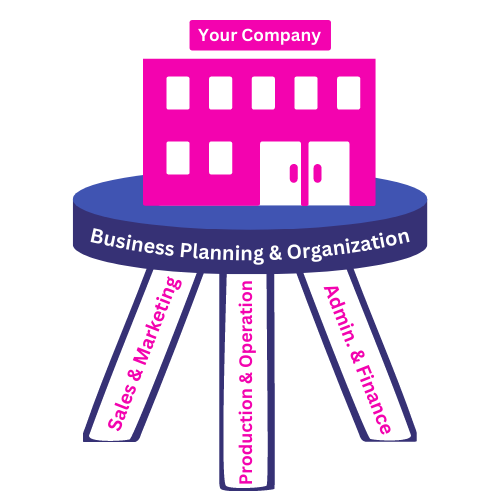

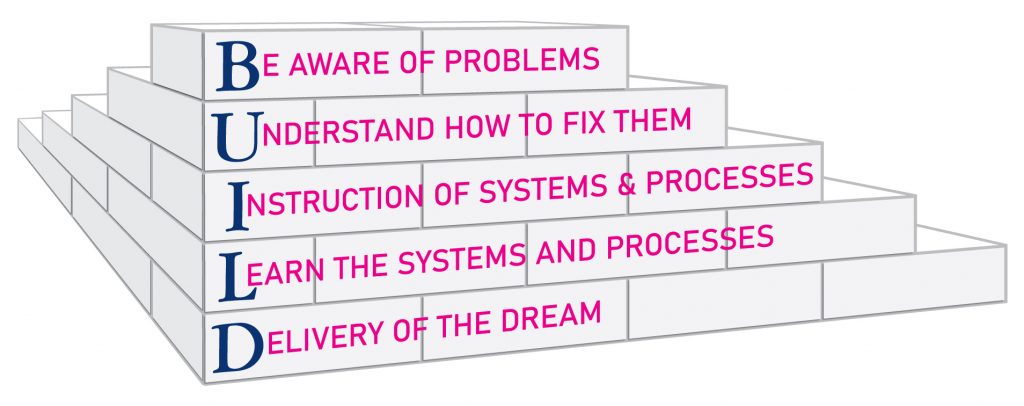

Our 5-step BUILD process helps us prioritize and manage all the hundreds of decisions we’re faced with every day in our business. You can find out if the business building tools are right for you here.