Because it Helps Keep Your Business Balanced

Recently we discussed the importance of keeping your construction business from getting out of balance. Achieving a balanced business requires paperwork and we know how construction contractors feel about paperwork.

I know, I know, paperwork is not a very exciting topic, but neither is concrete. And we all know how important concrete is in supporting a building. The same is true for paperwork and your business.

One of the three foundational piers in business is administration and finance. One of the building blocks in that pier is a Production Tracker. This tool provides valuable information for forecasting the company’s financial needs and production plans.

Wouldn’t it be helpful if you knew:

- Which types of work were consistently the most profitable

- How you were doing at meeting your financial goals for the year

- When you should have the signed projects finished to stay on track

- How well you’re doing at getting proposals signed

- What the average price of your projects are

The Production Tracker is an Excel spreadsheet that lets you gather and track information. It has preset formulas that determine and sort the information you need to make your business more profitable.

This document provides information for:

- Creating and recording project numbers

- Tracking project bid amounts

- Tracking dollars of signed proposals

- Tracking dollars collected from projects

- Percentage of jobs signed

- Percentage of dollars signed per dollars bid

- Percentage of dollars collected per signed

- Average dollar amount of projects bid

- Average dollar amount of projects signed

- Average dollar amount of projects collected

- Projected timeframe for doing signed projects

- Projected date work should be done

This list can seem overwhelming but it’s really not.

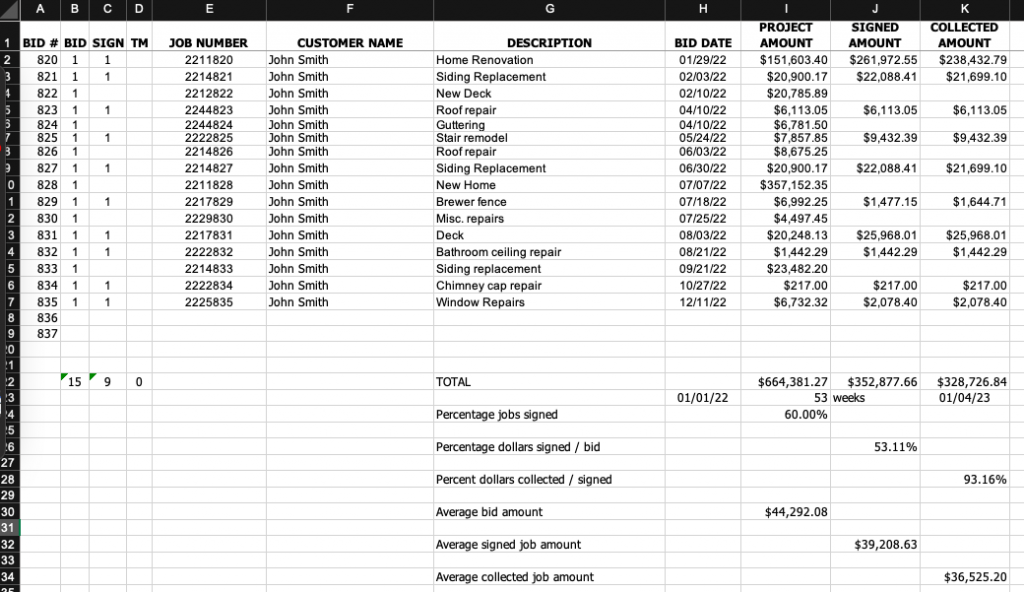

Here is an example of what the Job List spreadsheet looks like.

Let’s go through the document and break it down into smaller brick size pieces.

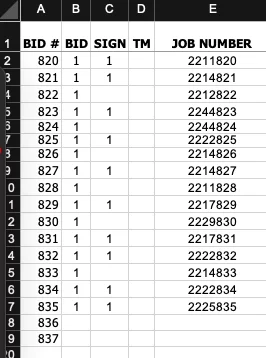

Creating and recording project numbers – Having a numbering system can help you sort projects so that you can review which types and size of projects are the most profitable and what you do the most of. It may be that your most profitable ones are not the ones you do the most often. Having this type of information can help you to focus more of your attention on the right kinds of projects for you.

This Production Tracker is a place to list project numbers in conjunction with the size and types of the projects, as well as their chronological order. This document provides the numerical part of the project number specific to each project. The other portion of the project number is determined by job specific parameters that are not included on this document.

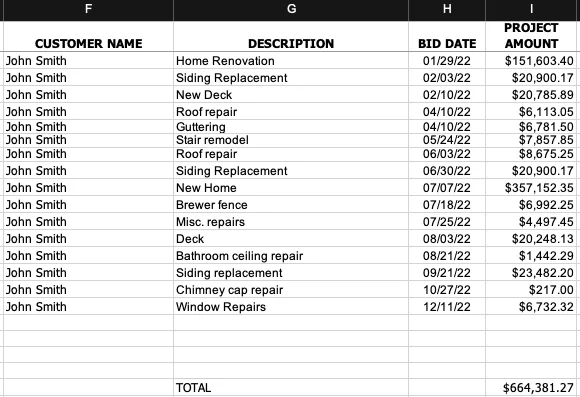

Tracking project bid amounts – Our Blueprint for Building a Better Proposal system provides the dollar amount for each project. Once a proposal has finished, the specific information to that project is entered into the appropriate cells on the spreadsheet. This information includes Job Number (column E), the Customer Name (column F), Description (column G), Bid Date (column H) and the Project Amount (column I). Regardless of the system you use for preparing proposals, you should have a dollar amount that could be entered into this document.

As each new project amount is added in the project amount column, the total project amount at the bottom will update, giving you a total dollar amount of the proposals you have done this year. Based on your company’s history, this dollar amount should give you a clear picture of where you are in relation to meeting your financial goals for the year. We will explain this further with the tracking dollars of signed projects.

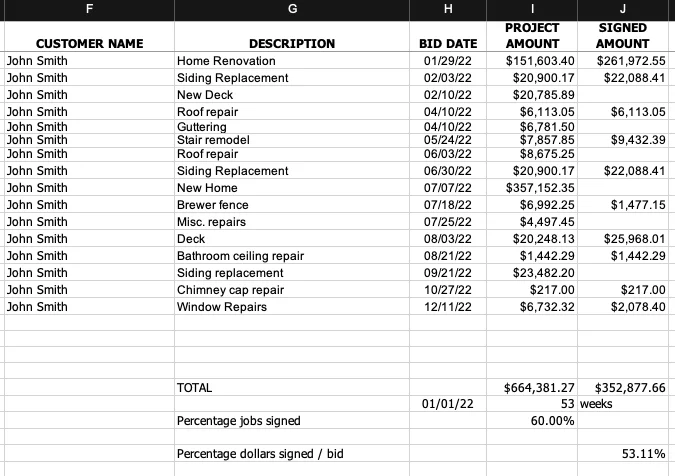

Tracking dollars of signed proposals – Once a proposal has been accepted, the accepted dollar amount should be entered in the signed amount column. Initially, this amount should be the same as the amount in the project amount column. Sometimes the dollar amounts of projects are changed due to change orders. This can be either an increase or decrease depending on the change order(s).

As each new proposal gets signed the dollar amount of the signed proposal should be entered into the correlating cell in the signed amount column. Just like in the project amount column, as each new amount is entered in the signed amount column, the total dollar amount at the bottom automatically updates giving you a total of work you must currently do.

With the total of the signed amount column and the total of the project amount columns, you should be able to get a clear picture of where you are financially in relation to where you want to be at year end.

Let’s say your goal for the year was to generate a gross revenue of $400,000.00. Using the example, you can see that as of December 12th you were at $352,877.66. This is close, but not quite there. If you compare the signed amount to the project amount ($664,381.27) you will see that the signed amount is 53.11% of the project amount. Based on this percentage, to get the signed amount to $400,000.00, the project amount would need to be $754,000.00.

This information is critical to the survival of your construction business.

Your business needs to be built on a solid foundation.

We’ve covered a lot here today. In our next post we’ll pick up at tracking dollars collected from projects.

Check out this and additional business building tools and training here. If you have questions, feel free to schedule a free 30-minute business coaching call.

Portions from a previous post 1/7/23

The “Job List” Is One of the Foundational Building Blocks of a Successful Construction Company

There is so much required to operate a business and it’s hard to keep everything balanced. There are

There is so much required to operate a business and it’s hard to keep everything balanced. There are  I wanted, at a glance, to know if we were on target for the current year’s financial goals. This way adjustments could be made before the financial support leg got too weak. I also wanted to be able to see how the company’s income and expenses compared with last week or last year at any time throughout the year.

I wanted, at a glance, to know if we were on target for the current year’s financial goals. This way adjustments could be made before the financial support leg got too weak. I also wanted to be able to see how the company’s income and expenses compared with last week or last year at any time throughout the year.

If you don’t like where you currently are then it’s time to sharpen your pencil and get ready to answer the next questions. WHERE do you want to be? This will be different for everybody, but it needs to be answered. Do you want to have money put back for your retirement? Do you want to be out of debt so that you aren’t feeling the pressure that comes with owing money to someone? Maybe you are just tired of your life being out of control and living paycheck to paycheck. Whatever the answer to this question, once you’ve answered it, you then have a destination. If you don’t have a map how will you ever be able to get there?

If you don’t like where you currently are then it’s time to sharpen your pencil and get ready to answer the next questions. WHERE do you want to be? This will be different for everybody, but it needs to be answered. Do you want to have money put back for your retirement? Do you want to be out of debt so that you aren’t feeling the pressure that comes with owing money to someone? Maybe you are just tired of your life being out of control and living paycheck to paycheck. Whatever the answer to this question, once you’ve answered it, you then have a destination. If you don’t have a map how will you ever be able to get there?